Explore web search results related to this domain and discover relevant information.

Careers.occ.gov Join one of the best places to work. ... Your credit report affects your ability to get a loan as well as the interest rate you will be required to pay.

The Fair and Accurate Credit Transactions Act (FACTA) provides you with better access to your credit information. Under FACTA, consumers are entitled to one free credit report every 12 months from each of the three credit bureaus (Equifax, TransUnion, and Experian).The Fair Credit Reporting Act (FCRA) regulates the consumer credit reporting industry. In general, the FCRA requires that industry to report your consumer credit information in a fair, timely, and accurate manner. Banks and other lenders use this information to make lending decisions.If a lender denies credit or increases the cost of credit to you, it must give you the name and address of the consumer reporting agency from which it received your report. Under the FCRA, you have the right to review that report and correct any errors that may be in it.Annual Credit Report Request Service P.O. Box 105281 Atlanta, GA 30348-5281

For Kenya to climb further up the ratings ladder, it must reduce reliance on borrowing.

For Kenya to climb further up the ratings ladder, it must reduce reliance on borrowing. ... Global ratings agency S&P recently upgraded Kenya’s long-term sovereign credit rating from ‘B-’ to ‘B’.Help us continue bringing you unbiased news, in-depth investigations, and diverse perspectives. Your subscription keeps our mission alive and empowers us to provide high-quality, trustworthy journalism.

A fraud alert is free and notifies creditors to take extra steps to verify your identity before extending credit.

*Your credit score is calculated based on the VantageScore® 3.0 model.Free TransUnion® credit report & score. Free credit monitoring, alerts and personalized offers. All free, all in 1. No credit card required. Learn more.Add a free freeze to control who can access your credit information. Unfreeze to apply for credit.Get your free weekly credit report from annualcreditreport.com to stay on top of your credit health.

Experian members for whom Experian completed at least one negotiation and canceled at least one subscription averaged $631/year of anticipated savings. Subscription Cancellation and Bill Negotiation are available with eligible paid memberships. Then raise your credit scores instantly using ...

Experian members for whom Experian completed at least one negotiation and canceled at least one subscription averaged $631/year of anticipated savings. Subscription Cancellation and Bill Negotiation are available with eligible paid memberships. Then raise your credit scores instantly using bills like your cell phone, utilities, streaming services and eligible rent payments.øLet’s get startedApproval of your application will result in a hard inquiry, even if you’re unable to pass final verifications, which may impact your credit scores. Never shop for car insurance again. Let us monitor, shop and compare quotes to get you our best rate—for free.Sign up nowAdd or remove a fraud alert on your Experian credit file.See all credit support · The Experian Smart Money™ Debit Card is issued by Community Federal Savings Bank (CFSB), pursuant to a license from Mastercard International. Banking services provided by CFSB, Member FDIC.Introducing the digital checking account designed by credit experts. You could raise your credit scores just for paying bills like rent, internet and utilitiesø.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C. Fitch affirms Moldova’s credit rating at ’B+’ with stable outlook

Investing.com -- Fitch Ratings has affirmed Moldova’s Long-Term Foreign-Currency Issuer Default Rating at ’B+’ with a Stable Outlook, citing the country’s commitment to policies that have preserved macroeconomic stability despite multiple shocks.Moldova successfully mitigated an early 2025 energy shock when Russian gas supplies to Transnistria were interrupted. The country avoided significant disruptions through improved external buffers, alternative electricity imports, and increased domestic production including from renewables.Fitch projects Moldova’s current account deficit will increase to 17.6% of GDP in 2025 from 16% in 2024, highlighting vulnerability to energy price shocks. International reserves are expected to remain at $5.6 billion at end-2025, maintaining reserve coverage at 5.2 months of current external payments in 2026-2027, above the ’B’ median of 4.2 months.Economic growth is expected to recover to 1.4% in 2025 from 0.1% in 2024, accelerating to 3% in 2026 and 4% in 2027, supported by lower inflation, energy support measures, and recovery in agricultural output.

Shafaq News – Baghdad Iraq has sustained a stable “B” credit rating — a speculative grade that signals moderate financial risk — for ten consecutive years while cutting its foreign debt to just $9 bi

Iraq has sustained a stable “B” credit rating — a speculative grade that signals moderate financial risk — for ten consecutive years while cutting its foreign debt to just $9 billion, Prime Minister Mohammed Shia al-Sudani’s economic adviser Mazhar Muhammad Saleh said on Monday.Saleh told Shafaq News that remaining obligations include residual arrears from the 2004 Paris Club settlement, an international deal that restructured most of Iraq’s debt after the fall of Baath regime in 2003, as well as several commercial debts scheduled for clearance by 2028, and loans from development funds for liberated areas, which are expected to be fully repaid within the next decade.External debt currently stands at only 7–8 percent of gross domestic product (GDP), while total public debt — domestic and foreign combined — is between 35 and 40 percent of GDP, Saleh said, noting that both figures remain far below the international safe ceiling of 60 percent.According to Saleh, fluctuations in oil prices since 2014 forced Iraq to rely on domestic borrowing, which has now reached around 92 trillion dinars (about $64.7B), Half of that amount is held in the Central Bank of Iraq’s investment portfolio.

Kenya’s entire economy has weathered many storms including quiet loans landscape, weak inflows of diaspora remittances as well as foreign borrowing that has in the past continued to put pressure on the demand for dollar. It is good news that as of mid this year, Kenya’s forex reserves stood ...

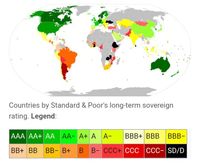

It is good news that as of mid this year, Kenya’s forex reserves stood at about $11.2 billion, powering the country’s exchange reserves. Nonetheless, a credit ratings agency, Standard & Poor’s (S&P), has upgraded Kenya’s long-term sovereign credit rating to B (from “B-”), speaking to a stable outlook.The agency added that the “easing circle” was powered by not only strong export performance, particularly in horticulture, tea, and minerals, but also stable exchange rate dynamics and limited inflation, which was 4.1 percent in July 2025. Private sector credit uptake has grown as well and is anticipated to accelerate further after the government clears supplier and contractual payment arrears, which should power overall GDP growth, despite numerous economic shocks such as commercial banks being hesitant to reduce lending rates.There is linear correlation of stability of a nation or its credit rating vs. how businesses and investors make decisions – a business wishing to establish a plant in a certain country, for example, may first evaluate the stability of that country by looking at its credit rating.Most countries depend on foreign investors to buy their debt, and these investors mostly rely on credit agencies’ credit ratings before anything else.

The Consumer Financial Protection Bureau (CFPB or Bureau) is amending Regulation B to implement changes to the Equal Credit Opportunity Act (ECOA) made by section 1071 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act). Consistent with section 1071, covered...

F. Conforming Amendments to Existing Regulation B ... Certain Purchases of Covered Credit Transactions, Including Pooled Loans and Partial Interests Proposed RuleF. Potential Benefits and Costs to Covered Financial Institutions and Small Businesses ... G. Potential Impact on Depository Institutions and Credit Unions With $10 Billion or Less in Total AssetsF. Description of the Steps the Agency Has Taken To Minimize the Significant Economic Impact on Small Entities Consistent With the Stated Objectives of Applicable Statutes, Including a Statement of the Factual, Policy, and Legal Reasons for Selecting the Alternative Adopted in the Final Rule and Why Each One of the Other Significant Alternatives to the Rule Considered by the Agency Which Affect the Impact on Small Entities Was Rejected; and for a Covered Agency, as Defined in Section 609(d)(2), a Description of the Steps the Agency Has Taken To Minimize Any Additional Cost of Credit for Small EntitiesAppendix F to Part 1002—Tolerances for Bona Fide Errors in Data Reported Under Subpart B · Supplement I to Part 1002—Official Interpretations · Section 1002.5—Rules Concerning Requests for Information ... 109(a)(3) Reporting Obligations Where Multiple Financial Institutions Are Involved in a Covered Credit Transaction

Global credit ratings agency S&P upgraded Kenya's long-term sovereign credit rating to 'B' from 'B-' on Friday, citing reduced near-term external liquidity risks.

A general view shows a section of the skyline of the central business district of Nairobi, Kenya July 15, 2025. REUTERS/Thomas Mukoya/File Photo Purchase Licensing Rights, opens new tab · Aug 22 (Reuters) - Global credit ratings agency S&P upgraded Kenya's long-term sovereign credit rating to 'B' from 'B-' on Friday, citing reduced near-term external liquidity risks.South Korea is working with U.S. authorities to bring home hundreds of Korean workers detained in an immigration raid in the state of Georgia, though it will be difficult to fly them back on Wednesday, Seoul's foreign ministry said.Robust export earnings and diaspora remittances have bolstered Kenya's foreign exchange reserves, helping ease pressures related to high external imbalances, the rating agency said in a statement.The economy is expected to grow by 5.6% this year, he added, which is above the Kenyan finance ministry's forecast of 5.3% and the central bank's projection of 5.2%.

Dive into the world of high-risk bonds with B-/B3 credit ratings. Learn about risk profile, default and recovery rates, and the allure of risk premiums. Explore why these ratings from Moody's, S&P, and Fitch demand attention in investment decision-making.

Corporate BasicsBasicsCorporate StructureCorporate FundamentalsCorporate DebtRisksEconomicsCorporate AccountingDividendsEarnings ... Credit ratings serve as a vital guide for investors, providing insights into the risk profile and financial health of a company or issuer.When delving into the realm of high-risk bonds, B-/B3 ratings signify a level of risk that commands attention. This article will take a deep dive into the implications of the B-/B3 credit rating and explore how these ratings shape investment decisions.The risk of an issuer defaulting, or not making the bond interest payments in a timely manner, is over 20%, with only 20% or so of those who defaulted resuming payments later (the “recovery rate”). To make this a risk worth taking, issuers of these bonds must make their yields relatively high compared to the investment grade, low-risk bonds. This higher rate is known as the risk premium, and how much more the premium is for a given amount of risk depends on market conditions, including how high the risk-free rate of 10-year Treasuries is. ... Keywords: treasuries, credit rating, junk bonds, S&P, high yield bonds, Moody's, Fitch, investment grade bonds, default rate, recovery rate, risk free,Explore the world of structured notes, an investment option that promises both potential gains and downside protection. This article delves into their advantages, including diversification and customization, and the potential pitfalls, such as credit risk, illiquidity, and tax implications.

Kenya’s foreign reserves rose sharply to $11.2 billion (Sh1.46 trillion) in July 2025, up from $6.6 billion (Sh858 billion) at the end of 2023, while the current account deficit narrowed to 1.3 per cent of GDP in 2024, compared to 2.6 per cent in 2023. - Kenya breaking news | Kenya news today ...

Kenya’s foreign reserves rose sharply to $11.2 billion (Sh1.46 trillion) in July 2025, up from $6.6 billion (Sh858 billion) at the end of 2023, while the current account deficit narrowed to 1.3 per cent of GDP in 2024, compared to 2.6 per cent in 2023. ... NAIROBI, Kenya, Aug 22 — Global credit rating agency S&P has upgraded Kenya’s long-term sovereign credit rating to ‘B’ from ‘B-’, citing stronger foreign exchange reserves and easing near-term external financing risks.This eased borrowing costs, lowering 91-day T-bill yields to 8 per cent in July 2025, from 16 per cent a year earlier. Inflation stayed contained at 4.1 per cent, while private sector credit has begun to recover.In this article:featured, foreign exchange reserves, forex, forex reserves, Kenya, S&P, sovereign credit rating ... The protest follows the leasing of the state-owned sugar mill to West Valley Sugar Company in May 2025. ... Faith Odhiambo rose as a fearless critic of state impunity. Now, by joining Ruto’s panel, the LSK boss faces accusations of betrayal and loss...Kenya’s foreign reserves rose sharply to $11.2 billion (Sh1.46 trillion) in July 2025, up from $6.6 billion (Sh858 billion) at the end of 2023, while the current account deficit narrowed to 1.3 per cent of GDP in 2024, compared to 2.6 per cent in 2023. - Kenya breaking news | Kenya news today | Capitalfm.co.ke

Official websites use .gov A .gov website belongs to an official government organization in the United States. Secure .gov websites use HTTPS A lock ( ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites. ... Credit reports ...

Official websites use .gov A .gov website belongs to an official government organization in the United States. Secure .gov websites use HTTPS A lock ( ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites. ... Credit reports list a history of your finances.Learn how to request credit reports, what information they include, and how lenders and other organizations may use them. By law, you can get a free credit report each year from the three credit reporting agencies (CRAs).If a credit reporting agency - Equifax, Experian, or TransUnion - denied your request for a credit report, contact them first to resolve the issue. If you cannot get your complaint resolved, contact the Consumer Financial Protection Bureau (CFPB).AnnualCreditReport.com is the only website authorized by the federal government to issue free, annual credit reports from the three CRAs.

Experian's history dates back to the early 1800s when a group of tailors in London started sharing information about customers who missed payments. However, the Experian name and the company's U.S. presence are the result of a series of mergers and acquisitions that happened in the mid-1990s. Today, Experian is a global leader in the credit ...

Experian's history dates back to the early 1800s when a group of tailors in London started sharing information about customers who missed payments. However, the Experian name and the company's U.S. presence are the result of a series of mergers and acquisitions that happened in the mid-1990s. Today, Experian is a global leader in the credit space, with information on over 1.5 billion consumers and 201 million businesses.TransUnion was created in 1968 as the parent holding company for a railcar leasing company, but acquired the Credit Bureau of Cook County the next year. TransUnion continued building its credit reporting business and it is now one of the largest credit bureaus in the U.S.Equifax has also expanded into global markets over the years and offers credit-related services in Asia Pacific, Canada, Europe and Latin America. There are also many specialty consumer reporting companies. Some focus on information that landlords want to know, such as whether you've ever been evicted, while other reporting companies track and report consumers' insurance claims or checking account history.The Consumer Financial Protection Bureau (CFPB) maintains a list of consumer reporting companies with details on how you can request a free copy of your consumer report from each company. Most of the credit bureaus' information comes from other companies. In the credit world, these companies are called data furnishers.

You may have heard the term "credit bureau" and wondered who they are and what they do. The simplest answer is that the three credit bureaus — Equifax®, Experian® and TransUnion® — receive and compile data about your borrowing and credit payment history.

Provide your credit information, through credit reports to your current and potential lenders, employers, insurers and others who have a lawful reason to request and view your credit reports. Potential lenders and others use your credit reports to get an idea of how risky it may be to lend to you, whether you pay your bills on time and other uses permitted by law.The decision to deny or approve an application lies with the lender or creditor. Each lender and creditor may have its own criteria. Banks, credit card companies, mortgage and auto lenders, debt collectors and others voluntarily send account information to NCRAs.A creditor may not send data to all three NCRAs so your credit reports from each NCRA may contain different information. Creditors generally share updated account information with NCRAs monthly. NCRAs also obtain data from public bankruptcy court records.Identifying information: This section of your Equifax credit report, which is not used to calculate your credit scores, includes personal information, such as your name, address, Social Security number and date of birth.

S&P noted that Kenya’s economic growth prospects remain favorable. The economy is expected to expand by 5.6% in 2025.

Although commercial banks have been slow to lower lending rates, S&P said that the private sector credit growth has begun to recover and it is expected to accelerate further following the government’s clearance of supplier and contractual payment arrears, which should support overall GDP growth.The agency also revised Kenya’s transfer and convertibility assessment to ‘B+’ from ‘B’. Also Read: Win for Kenya as Rutto Eyes $17 Trillion EU Economy · S&P Global Ratings evaluates the creditworthiness of debt instruments—such as bonds—and the entities that issue them.President William Ruto, while speaking earlier in the week in Japan on the sidelines of the Tokyo International Conference on African Development (TICAD 9), expressed optimism about the country’s economic trajectory. The Head of State projected Kenya’s economy to grow by 5.6% in 2025. Also Read: Kenya’s Credit Outlook Revised to Positive, Rating Affirmed Ahead of Finance Bill 2025Speaking during a Presidential Dialogue on the Establishment of an Africa Credit Rating Agency held in Addis Ababa, Ethiopia, on February 14, 2025, Ruto emphasized that the current global financial architecture, particularly the credit rating ecosystem, systematically undervalues Africa’s economic reality. The dialogue, held on the sidelines of the 37th African Union Ordinary Summit, was facilitated by the African Peer Review Mechanism (APRM) and attended by multiple Heads of State, financial experts, policymakers, and international development partners.

Your credit reports and scores have an impact on your finances. Our resources can help you better understand them, learn how to correct errors, and improve your credit record over time.

You know your credit report is important, but the information that credit reporting companies use to create that report is just as important—and you have a right to see that data.You should check your credit reports at least once a year to make sure there are no errors that could keep you from getting credit or the best available terms on a loan.Once you request your credit reports, it’s important to know what kind of information you should be on the lookout for as you review them.Your credit reports and credit scores are both critical to your financial health, but they play very different roles.

They offer investors and financial institutions insights into the creditworthiness of corporations, municipalities, insurers, and individual bond issues. One specific credit rating, the BB-/Ba3, often misunderstood and underrated, merits attention. Representing the same rating, BB- is used ...

They offer investors and financial institutions insights into the creditworthiness of corporations, municipalities, insurers, and individual bond issues. One specific credit rating, the BB-/Ba3, often misunderstood and underrated, merits attention. Representing the same rating, BB- is used by the Fitch and S&P agencies, while Moody's employs Ba3.Existing within a diverse spectrum of over 20 ratings, the BB-/Ba3 rating signals moderate default risk, standing close to the middle of the scale. Fitch and S&P’s BB- and Moody’s Ba3 all denote similar degrees of credit risk and are used interchangeably within the financial industry.When examined closer, BB- rating in Fitch and S&P's taxonomy falls between B+ and BB, while Moody's Ba3 rating stands above B1 and below Ba2. The relative position of these ratings within their respective scales further attests to their status as mid-tier credit ratings.The BB-/Ba3 credit rating, given to bonds, companies, insurers, and municipalities, among others, has several distinctive features. The rating might indicate non-investment-grade status, rendering the rated bonds as high-yield or junk bonds.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C. Fitch affirms Moldova’s credit rating at ’B+’ with stable outlook

Investing.com -- Fitch Ratings has affirmed Moldova’s Long-Term Foreign-Currency Issuer Default Rating at ’B+’ with a Stable Outlook, citing the country’s commitment to policies that have preserved macroeconomic stability despite multiple shocks.Moldova successfully mitigated an early 2025 energy shock when Russian gas supplies to Transnistria were interrupted. The country avoided significant disruptions through improved external buffers, alternative electricity imports, and increased domestic production including from renewables.Fitch projects Moldova’s current account deficit will increase to 17.6% of GDP in 2025 from 16% in 2024, highlighting vulnerability to energy price shocks. International reserves are expected to remain at $5.6 billion at end-2025, maintaining reserve coverage at 5.2 months of current external payments in 2026-2027, above the ’B’ median of 4.2 months.Economic growth is expected to recover to 1.4% in 2025 from 0.1% in 2024, accelerating to 3% in 2026 and 4% in 2027, supported by lower inflation, energy support measures, and recovery in agricultural output.

This may influence which products ... site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners. Experian, Equifax and TransUnion are the three credit reporting ...

This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners. Experian, Equifax and TransUnion are the three credit reporting agencies that gather data about your finances and compile them into credit reports, which determine your credit score.Amanda Barroso, Ph.D., is a writer and content strategist helping consumers navigate budgeting, credit building and credit scoring. Before joining NerdWallet, Amanda wrote about demographic trends at the Pew Research Center and earned a Ph.D.Bev O'Shea is a former NerdWallet authority on consumer credit, scams and identity theft. She holds a bachelor's degree in journalism from Auburn University and a master's in education from Georgia State University. Before coming to NerdWallet, she worked for daily newspapers, MSN Money and Credit.com.Her work has appeared in The New York Times, The Washington Post, the Los Angeles Times, MarketWatch, USA Today, MSN Money and elsewhere. Twitter: @BeverlyOShea. ... Did you know... Credit bureaus matter because they shape your credit reports and scores, which influence whether you can get loans, credit cards or even housing.

Checking your own credit will NOT harm it. Our products help keep you informed and better protected.

Equifax credit monitoring & ID theft protection features for one adult. ... $99.95 / year. Cancel at any time. Refund provided for any fully unused months; no partial month refunds.3 Sign Up NowSign Up Now Learn More · 3-bureau credit features & extra ID theft protection features for one adult.Credit and ID theft protection features for the family. ... $299.95 / year. Cancel at any time. Refund provided for any fully unused months; no partial month refunds.3 Sign Up NowSign Up Now Learn More ... You may benefit from a 0% intro APR credit card offer, better rates or a rewards program.And if you've been the victim of identity theft, find out what you can do immediately to begin the recovery process. ... Access helpful services and useful information to help you take control of your credit report, and better protect yourself from identity theft and fraud.Entities that may still have access to your Equifax credit report include: companies like Equifax Consumer Services LLC, which provide you with access to your credit report or credit score, or monitor your credit report as part of a subscription or similar service; companies that provide you with a copy of your credit report or credit score, upon your request; federal, state and local government agencies and courts in certain circumstances; companies using the information in connection with the underwriting of insurance, or for employment, tenant or background screening purposes; companies tha